Unveiling China's Manufacturing Might: The Era of Superior Hydraulic Cylinders

The manufacturing landscape in China is undergoing a transformative phase, particularly evident in the realm of hydraulic cylinders. As the demand for robust and efficient machinery escalates, the introduction of the New Hydraulic Cylinder has marked a significant advancement in industry standards. According to a report by MarketsandMarkets, the global hydraulic cylinder market is projected to reach USD 18.2 billion by 2025, growing at a CAGR of 6.5%. This growth is driven by an increasing need for automation and efficiency across sectors such as construction, agriculture, and manufacturing. China, as a key player in this segment, is enhancing its production capabilities to meet international standards and consumer expectations. The pursuit of superior hydraulic cylinders showcases not only the engineering prowess of Chinese manufacturers but also their commitment to innovation and excellence in an ever-evolving market.

Understanding the Role of Hydraulic Cylinders in China's Manufacturing Sector

Hydraulic cylinders play a pivotal role in China's manufacturing sector, particularly in industries such as construction and marine engineering. The global hydraulic cylinder market, estimated at USD 14.3 billion in 2021, is projected to grow to USD 18.3 billion by 2027, showcasing the increasing demand for robust and efficient hydraulic solutions. In line with this trend, China's focus on self-reliance in technology has led to remarkable innovations, including the unveiling of the world's most powerful hydraulic cylinder, designed for marine pile driving operations. This development not only strengthens China's manufacturing capabilities but also positions the nation as a leader in hydraulic technology advancements.

Furthermore, China has made significant strides in shipbuilding with the launch of the world’s largest pile-driving vessel, which incorporates the latest hydraulic cylinder technology. According to industry reports, the hydraulic cylinders market is expected to reach $21.24 billion by 2030, reflecting a compound annual growth rate (CAGR) of 4%. This growth is driven by increasing project demands and advancements in hydraulic systems, thereby highlighting the crucial role hydraulic cylinders play in bolstering China's manufacturing output and technological prowess.

Key Features that Set Superior Hydraulic Cylinders Apart

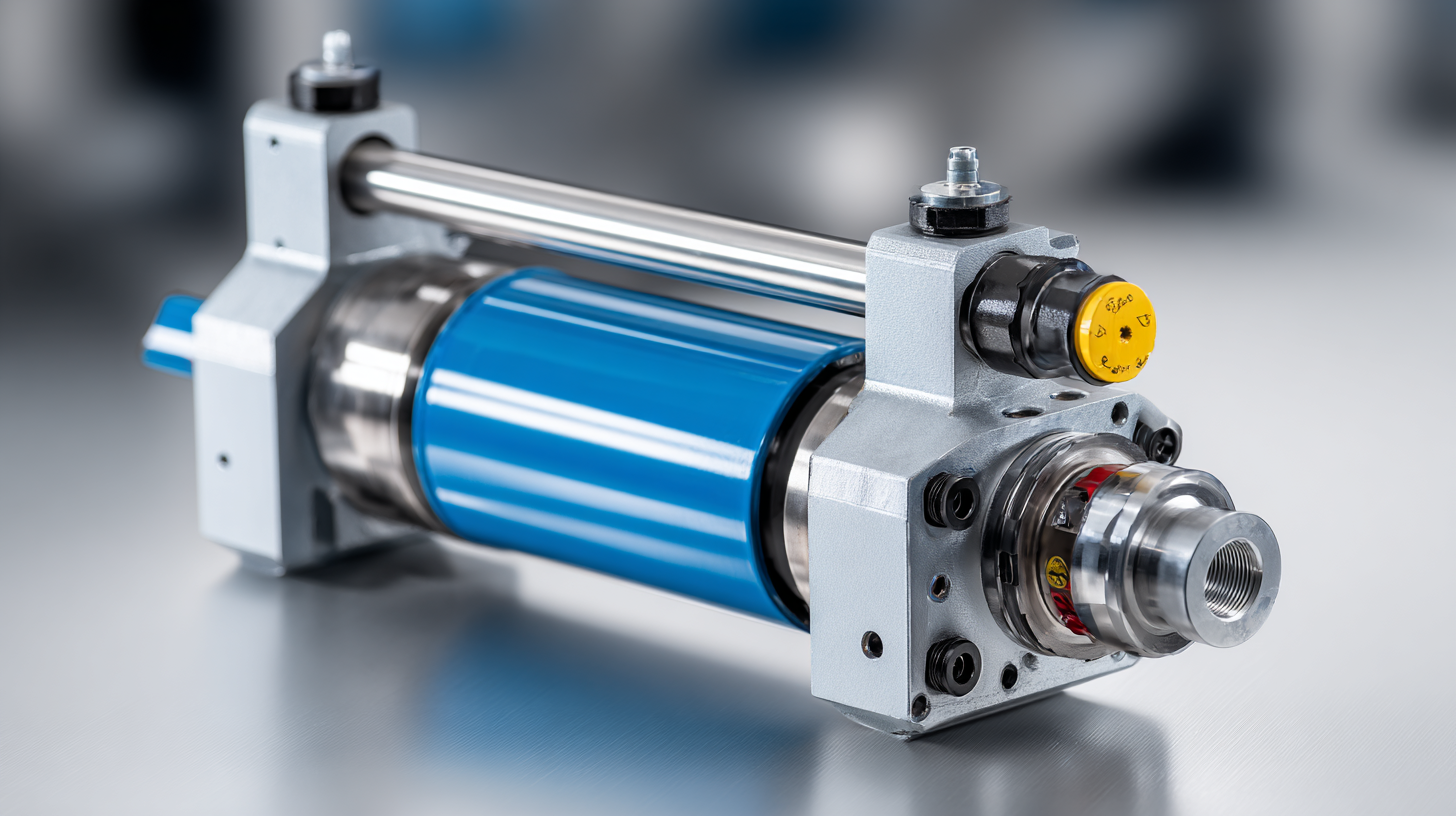

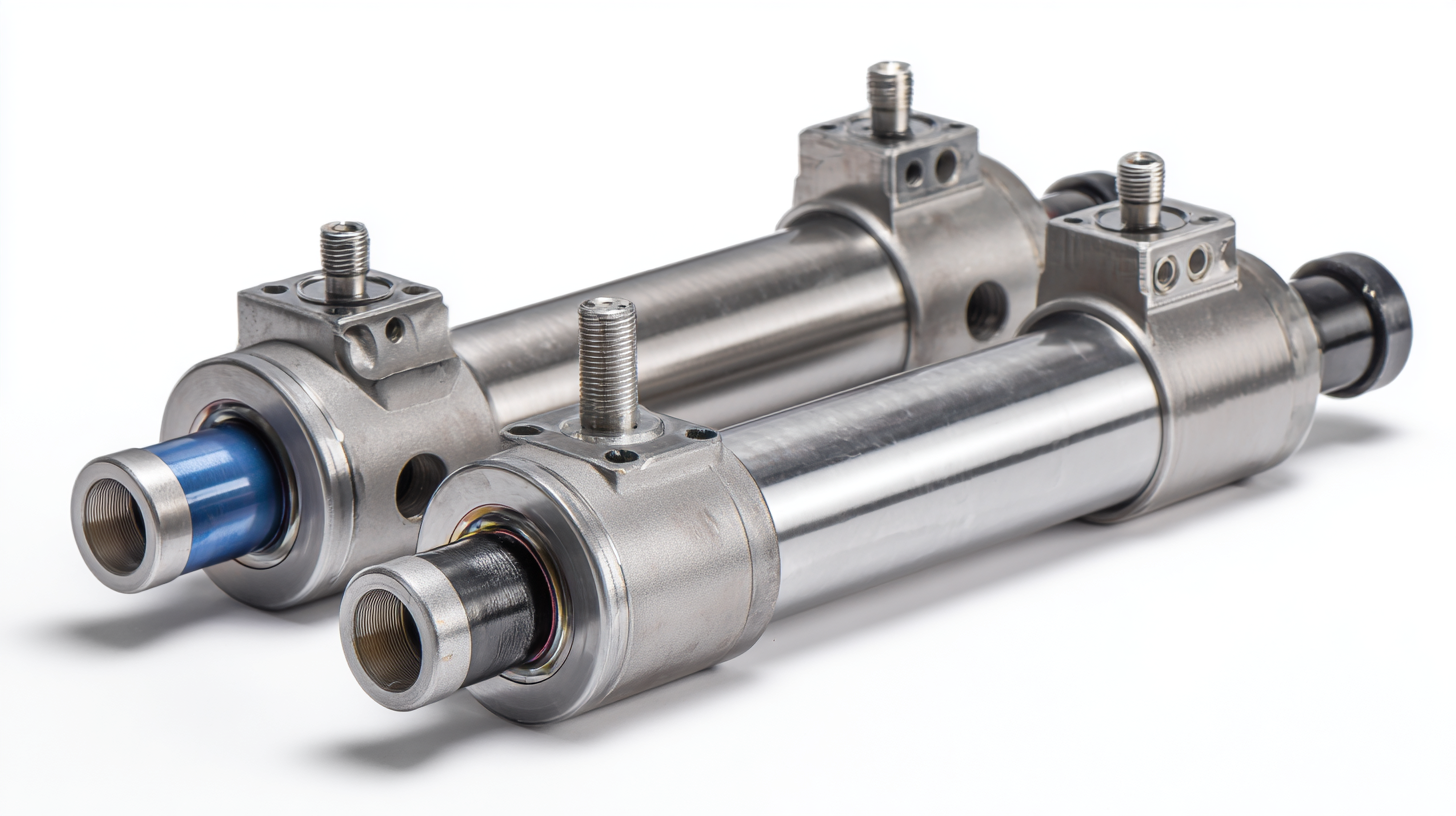

The hydraulic cylinder industry in China is experiencing a remarkable transformation, driven by advancements in technology and innovation. Superior hydraulic cylinders stand out in this competitive landscape due to their exceptional key features. One of the defining characteristics is their enhanced durability, achieved through the use of high-quality materials and precision engineering. This ensures that they can withstand extreme conditions and operate efficiently over extended periods, making them ideal for various industries such as construction, manufacturing, and agriculture.

Another critical feature that sets superior hydraulic cylinders apart is their superior performance metrics. These cylinders are designed with optimized flow dynamics that reduce energy consumption and increase operational efficiency. Additionally, advanced seal technology is employed to minimize leakage and maximize the longevity of the cylinders. Manufacturers are also investing in smart technologies, integrating sensors and IoT capabilities that facilitate real-time monitoring and predictive maintenance, ultimately leading to reduced downtime and enhanced productivity for users. As China continues to assert its dominance in manufacturing, these innovations in hydraulic cylinder technology represent a significant leap forward, promising unparalleled performance and reliability.

Unveiling China's Manufacturing Might: The Era of Superior Hydraulic Cylinders

This chart illustrates key performance metrics of superior hydraulic cylinders compared to standard hydraulic cylinders across several dimensions, highlighting China's advancements in hydraulic technology and manufacturing capabilities.

Essential Factors to Consider When Choosing Hydraulic Cylinders

When it comes to hydraulic cylinders, choosing the right one is pivotal for optimizing performance and ensuring reliability in various industrial applications. The global hydraulic cylinder market, valued at $10.94 billion in 2018, is projected to reach $19.77 billion by 2032, growing at a compound annual growth rate (CAGR) of 4% during the forecast period. This growth is indicative of increasing demand across multiple sectors, which necessitates careful consideration of several essential factors.

One key aspect to consider is the operating environment of the hydraulic cylinder. Factors like temperature extremes, exposure to corrosive substances, and the overall operating pressure play critical roles in determining the suitability and longevity of the cylinder materials. Additionally, it's vital to assess the cylinder’s stroke length and bore size, as these specifications directly impact the efficiency and power of the machinery they operate.

With innovation driving advancements in design and manufacturing, selecting hydraulic cylinders that align with both operational needs and safety standards can significantly enhance productivity and reduce downtime in industrial processes.

The Impact of Advancements in Hydraulic Technology on Manufacturing Efficiency

The advancements in hydraulic technology have paved the way for significant improvements in manufacturing efficiency, marking a transformative era for industries globally. As hydraulic systems become more integrated with modern technologies, manufacturers are able to optimize their operations like never before. These innovations have not only enhanced the performance of hydraulic cylinders but have also translated into tangible benefits in productivity and sustainability within sectors such as automotive and aerospace.

For instance, the shift towards more energy-efficient and low-pollutant hydraulic systems demonstrates a commitment to reducing environmental impact while still meeting increasing production demands. Improved designs and integration of cutting-edge technology allow for record production rates, as exemplified by the enhanced crude oil output in the U.S. despite fewer active drilling rigs. This evolving landscape underscores the necessity for manufacturers to embrace these technological advancements in order to remain competitive and contribute to a more sustainable future.

Unveiling China's Manufacturing Might: The Era of Superior Hydraulic Cylinders

| Dimension | Value | Impact on Manufacturing |

|---|---|---|

| Cylinder Bore Diameter (mm) | 50 - 300 | Enhanced lifting capacity and precision |

| Operating Pressure (MPa) | 10 - 25 | Improved efficiency in operations |

| Average Cycle Time (s) | 1.5 - 3.5 | Reduction in downtime during processes |

| Energy Efficiency (% Savings) | 15 - 30 | Lower operational costs |

| Maintenance Interval (h) | 500 - 2000 | Increased uptime and reduced maintenance costs |

Future Trends in Hydraulic Cylinder Production and Their Global Implications

The global hydraulic cylinder market is experiencing significant growth, with revenue estimated to reach USD 18.3 billion by 2027, up from USD 14.3 billion in 2021. This growth can be attributed to positive market conditions in various sectors, including manufacturing, heavy equipment, and oil & gas. As these industries expand, the demand for hydraulic cylinders will continue to rise, reflecting the overall trend of increasing reliance on hydraulic systems in fluid power applications.

Forecasts suggest that the hydraulic cylinder market will achieve a compound annual growth rate (CAGR) of approximately 4.15%, ultimately reaching USD 9.2 billion by 2035. The increasing investment in industrial hydraulic equipment, which encompasses components like pumps, motors, and transmission systems, further underlines the necessity for high-performance hydraulic cylinders. As these trends evolve, manufacturers in China and beyond will need to innovate and adapt to maintain competitive advantages in this lucrative market, positioning themselves for the future demands of a globalized industry.